Proper Treatment of Army Reserve Personnel by Alyssa Perez

Planning for Ownership and Inheritance of Pension and IRA Accounts and Benefits by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron, Part VI

Seminar Spotlight – University of Florida Tax Institute

Donate to the Stephen A. Lind Eminent Scholar Chair

Richard Connolly’s World – What’s New with Law School Programs

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Proper Treatment of Army Reserve Personnel

by Alyssa Perez

Many companies hire military personnel while they are at home. But what happens when they are once again called upon to perform their military duties? What is the obligation of the employer?

What is a reservist?

A reservist is a person who is a member of a military reserve force. They are otherwise civilians, and hold careers outside of the military. All five branches of the United States armed forces have their own Reserve Forces, whose reservists can be called upon to serve anywhere at any time. During times of peace, the Reservists spend one weekend a month and two weeks a year annually in training. Otherwise, the Reservists are available to continue working at their respective employers.

What federal law allows reservists to maintain employment, and when was it enacted?

The Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA) is a federal law that establishes the rights and responsibilities for the uniformed services members and their civilian employers. This law is intended to ensure that persons who serve or have served in the Armed Forces, Reserves, National Guard or other uniformed services are (1) not disadvantaged in their civilian careers because of their service; (2) are promptly reemployed in their civilian jobs upon their return from duty; and (3) are not discriminated against in employment based on past, present, or future military service.1 USERRA protects the job rights of individuals who voluntarily or involuntarily leave employment positions to participate in the uniformed services. It also prohibits employers from discriminating against past and present members of the uniformed services as well as their applicants.2

The USERRA supercedes any state law, contract, agreement, policy or other matters that reduces, limits, or eliminates in any manner any right or benefit provided in the USERRA.3 Therefore, states cannot enact laws that would limit uniformed servicepeople from obtaining their civilian jobs nor can states discriminate against them.

What if the reservist volunteers for more than the required duty?

The USERRA protects the civilian careers of uniformed persons regardless of whether or not they voluntarily or involuntarily left their employment positions to serve. However, reservists do need to comply with section 4312 of the USERRA, which provides the reemployment rights of persons who serve in the uniformed services.

First, the reservist must give advance written or verbal notice of such service to their employer. Second, the cumulative length of absence and of all previous absences from a position of employment does not exceed five years. Third, the reservist should submit an application for reemployment to the employer.4 If there is a military necessity for the reservist, or giving notice is otherwise impossible or unreasonable, then it is not a requirement. However, the reservist must notify the employer of their intent to return to a position of employment with the employer upon completion of a period of service.5 If the reservist fails to report or apply for reemployment within the appropriate period, it will not automatically forfeit their entitlement to the rights and benefits of reemployment, but instead will subject the reservist to discipline regarding the employer’s conduct code.

A reservist has properly applied for reemployment if the application is timely; the person has not exceeded service limitations (i.e. 5 years); and the person’s entitlement to the benefits has not been terminated due to a separation from a uniformed service (i.e. discharge or dismissal).6 Further, a reservist is entitled to the position of employment in which the person would have been employed if the continuous employment of such person with the employer had not been interrupted by their service. If, after such reemployment, documentation becomes available that establishes that the reservist did not meet those requirements, the employer of such person may terminate the employment of the person.

An employer will violate the USERRA if the employer would not have taken an adverse employment action but for the employee’s military service or obligation.7 An employer will not be able to escape liability by claiming it was discriminating against an employee on the basis of his or her absence when that absence is for military service. However, if the reservist does not place the employer on notice prior to leaving the job for military service, the employer has a right to terminate them.

In the United States Federal Court of Appeals, the Erickson court held that the United States Postal Services’s removal of an employee for excessive use of military leave constituted discrimination under USERRA; however, because the employee failed to timely request reemployment, the termination could potentially be lawful.8 If an employee makes a discrimination claim under USERRA, they bear the initial burden of showing by a preponderance of the evidence that their military service was a substantial or motivating favor in the adverse employment action.9 If, however, the employer can demonstrate that it would have taken the same action without regard to the employee’s military service, the termination is lawful.10 Congress enacted USERRA in part to make clear that discrimination in employment occurs when a person’s military service is a “motivating factor,” and not to require that military service be the sole motivating factor for adverse employment action. The Court held that because USPS did not provide any other factors for adverse employment action besides plaintiff’s military duty, the court was discriminating under USERRA.

The plaintiff in Erickson, however, did not comply with USERRA rules regarding reemployment application. Section 4312 of the USERRA provides that when a person accepts duty for less than 31 days, they must report to the employer no later than the beginning of the first full calendar day following the completion of the period of service and that period will expire eight hours following the transport of the person to his or her place of residence.11 In the case of a person who performs uniformed services for more than 30 days but less than 181 days, they must submit an application for reemployment no later than 14 days after the completion of their service. If the person performs uniformed services for more than 180 days, they have 90 days to submit their application for reemployment.12 Therefore, if a reservist does not file their application for reemployment as required under the USERRA, it is proper to take adverse employment action against the reservist.

Conclusion:

Employers should not terminate employees simply because of long leaves of absence due to uniformed services. Whether the reservist chooses to perform their duties voluntarily or involuntarily is irrelevant. It is up to the employee to ensure that they too are in compliance with the USERRA. The reservist must give proper notice to the employer that they are leaving for uniformed service duty, and must, upon completion of that service, apply for reemployment as required by statute. If the reservist fails to give notice or apply for reemployment, the employer is able to take adverse employment action.

*********************************************

1Pub.L. 103–353, Oct. 13, 1994, codified as amended at 38 U.S.C. §§ 4301–4335.

2Id.

3Id at § 4302(b).

4Id at § 4312(a)-(b).

5Id at § 4312(e).

6Id.

7Erickson v. USPS, 571 F.3d 1364 (Fed. Cir. 2009).

8Id.

9See Sheehan v. Dep’t of the Navy, 240 F.3d 1009, 1013 (Fed.Cir.2001).

10Id at 1013.

11§ 4312(e).

12Id.

Planning for Ownership and Inheritance of Pension

and IRA Accounts and Benefits – Part VI

by Christopher J. Denicolo, Alan S. Gassman, and Brandon Ketron

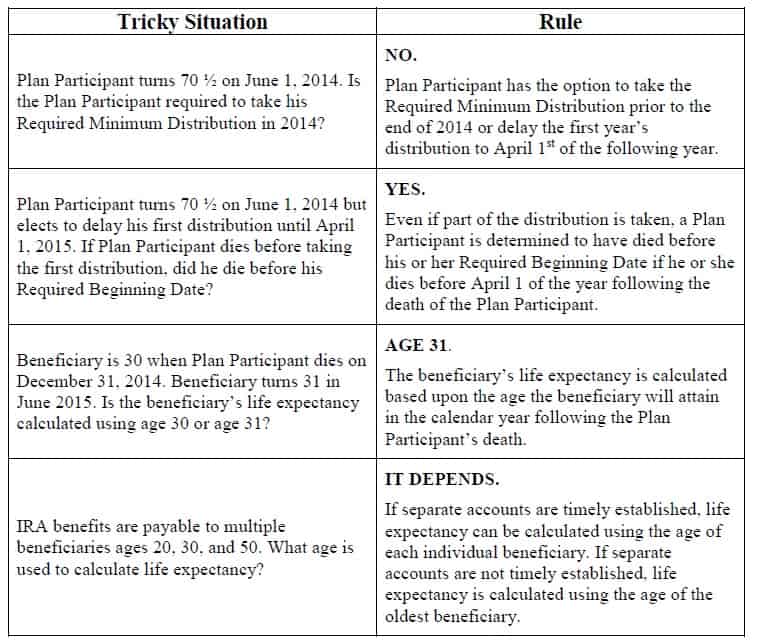

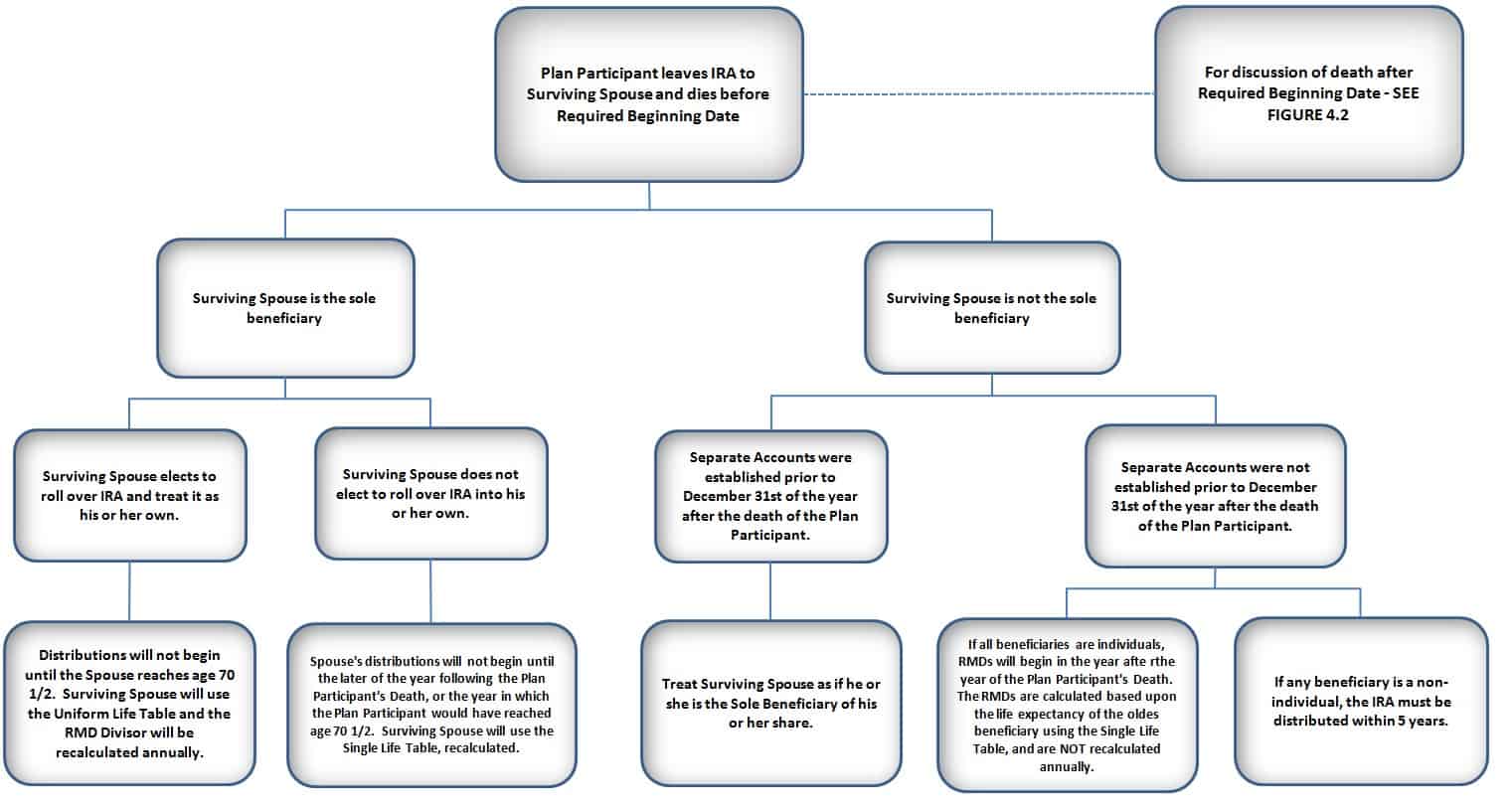

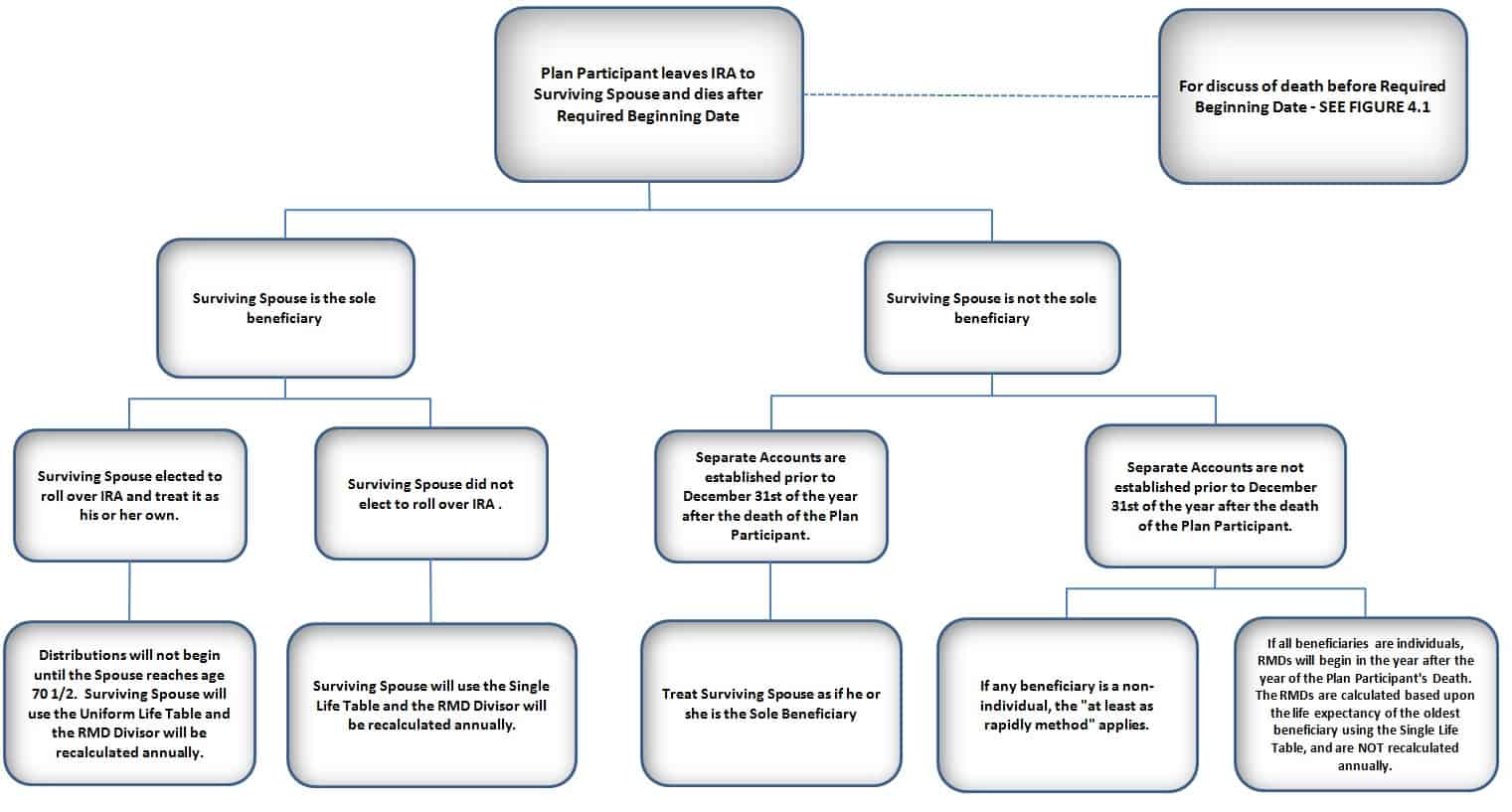

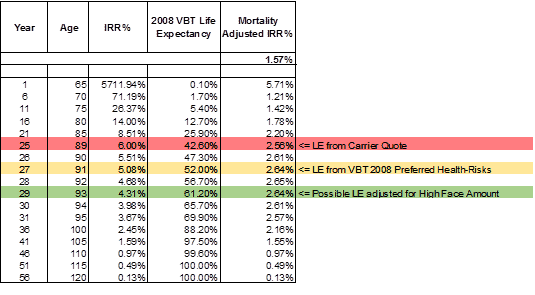

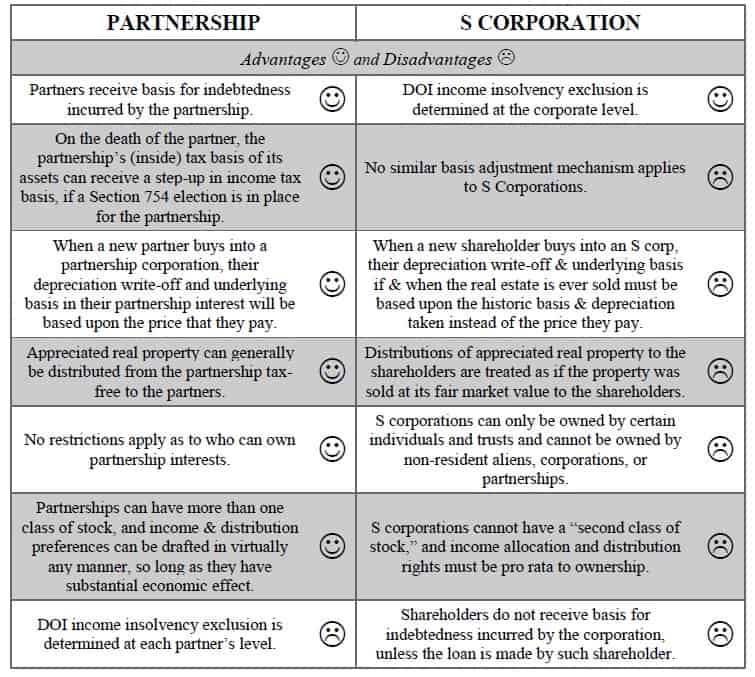

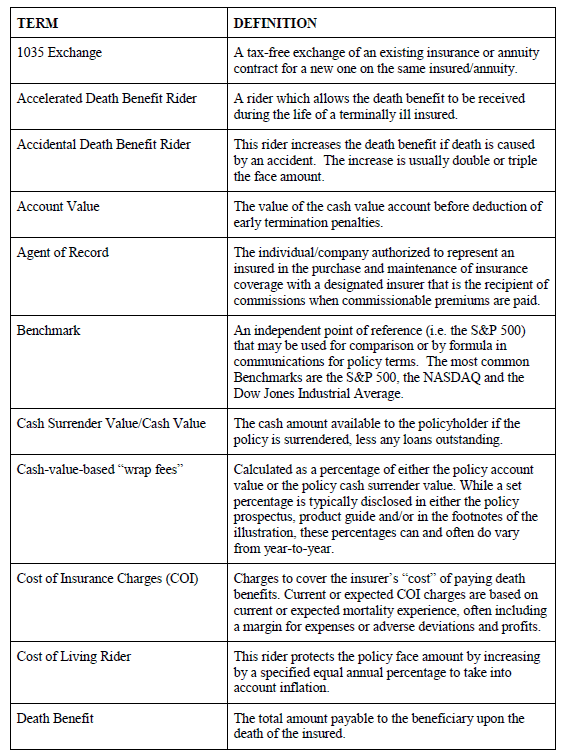

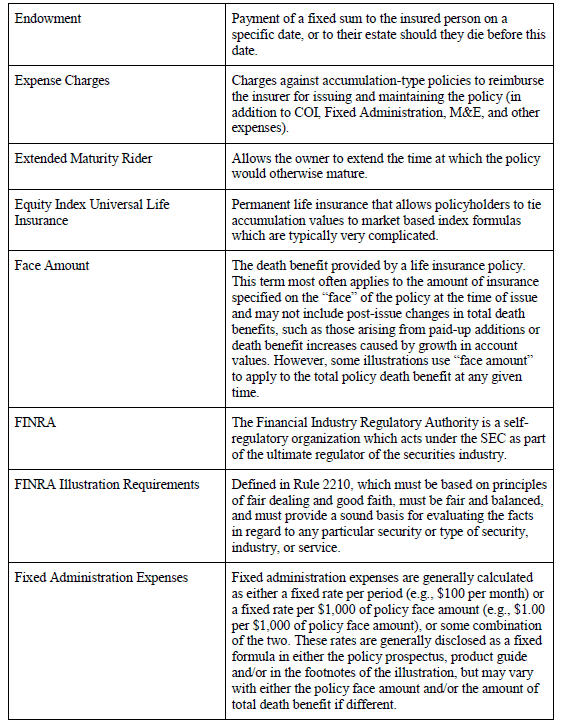

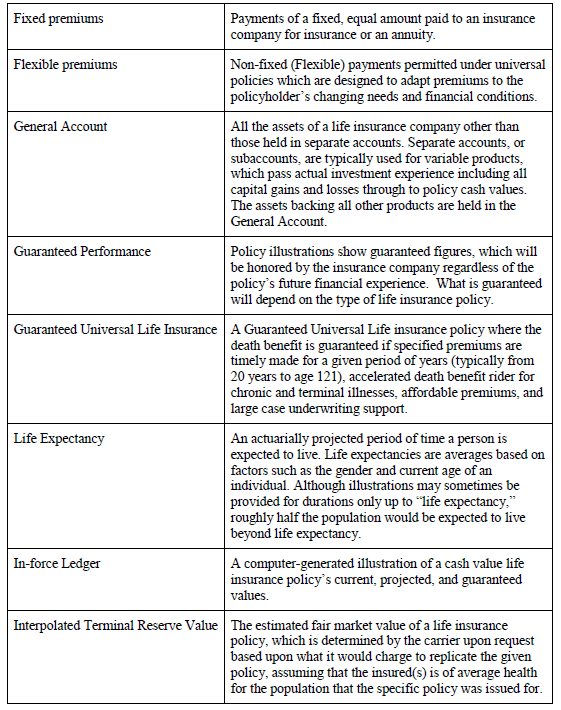

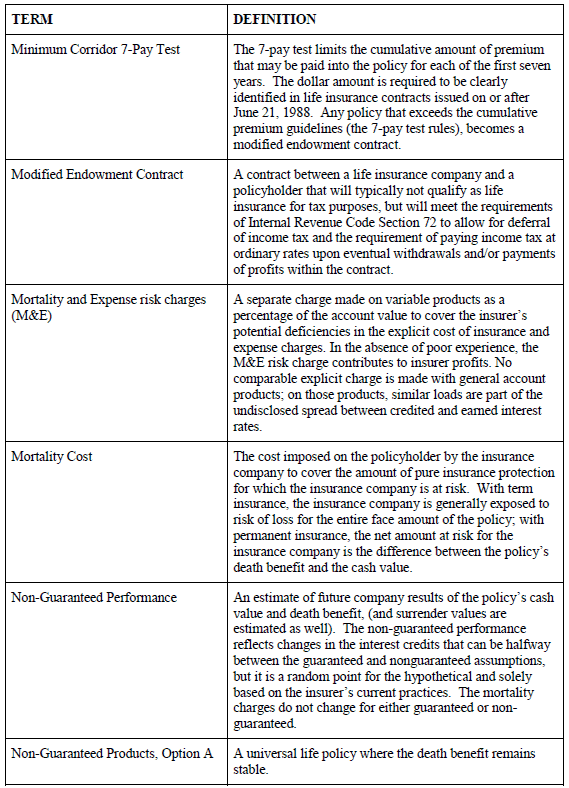

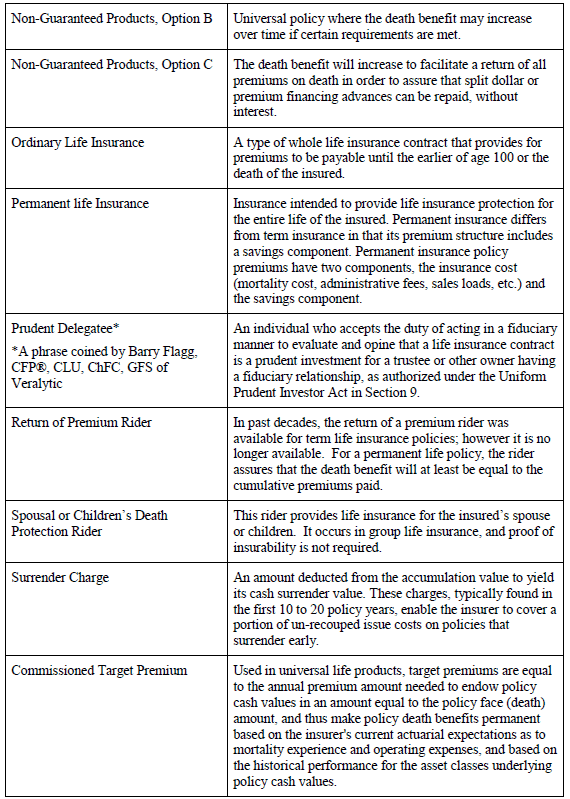

The rules applicable to retirement plan and IRA distributions, contributions, rollovers, and otherwise can be difficult to understand and complex to implement. The applicable Internal Revenue Code Sections and Treasury Regulations are somewhat complicated and convoluted, and use many technical “terms of art.” This makes dealing with qualified plans cumbersome and difficult for laypersons and planners who are not experienced in this area.

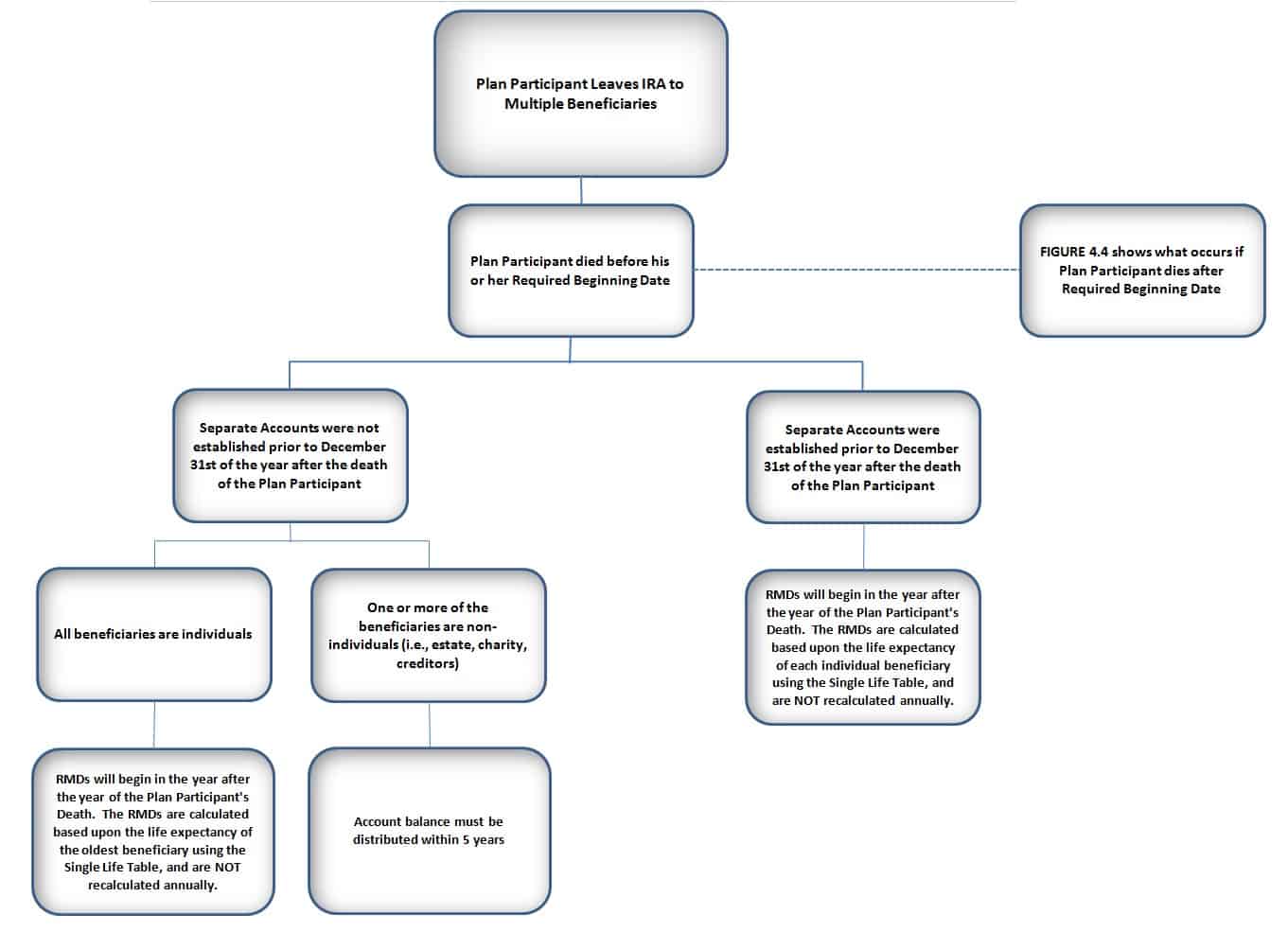

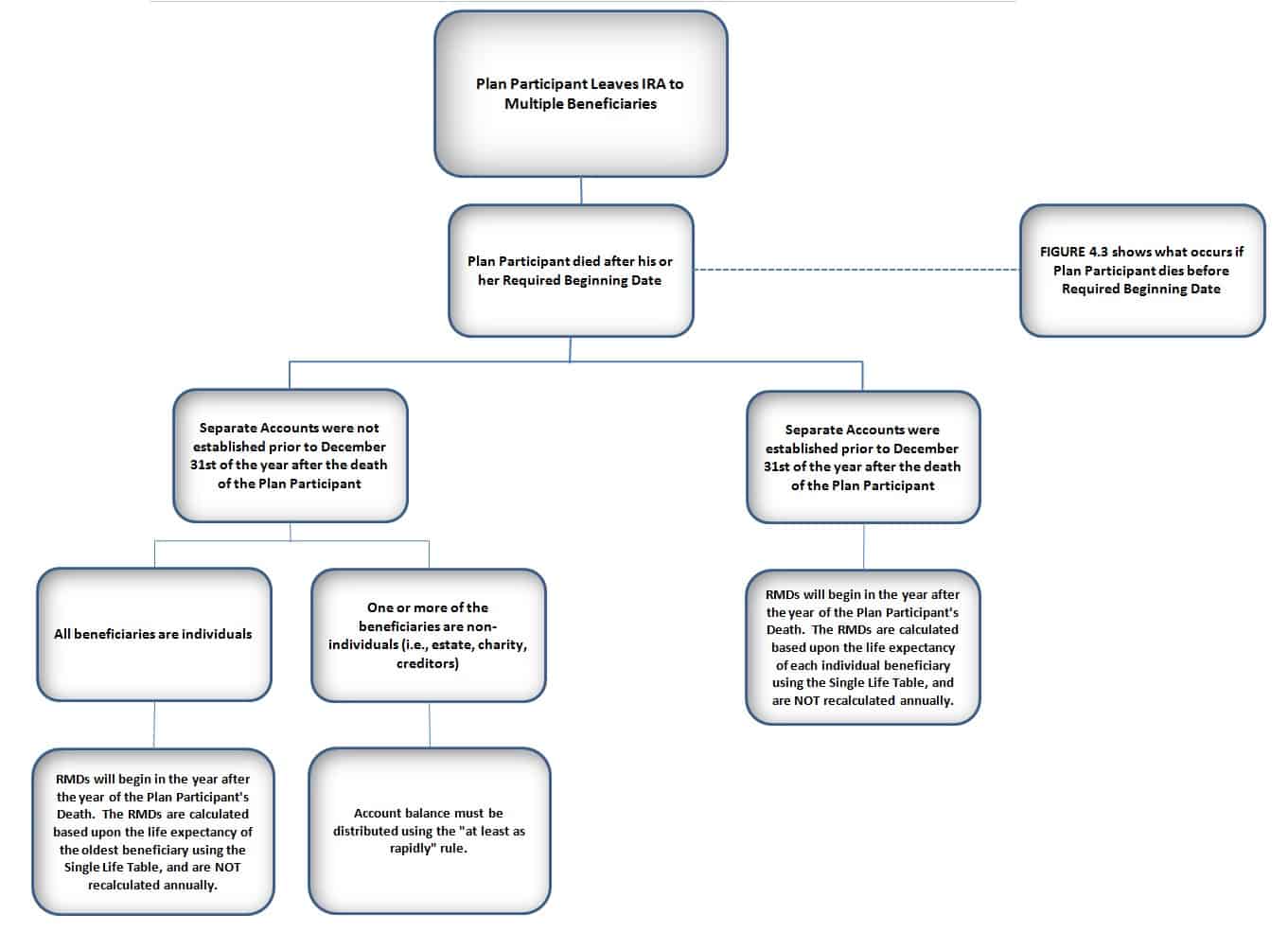

We have attempted to simplify the applicable rules into a digestible format with concise explanations of the applicable rules. We have also prepared charts and explanations to illustrate the key concepts and mechanics of important definitions, rules, and planning strategies.

The Thursday Report proudly will provide a multi-part series to exhibit our materials and charts, and we hope that you enjoy this series as much as we did in putting it together.

To see previous editions of this presentation, please click below:

IRA SERIES CHAPTER 6

IRA and Plan Benefits Payable to Trusts

Probably the most complicated and misunderstood area of IRA and retirement plan structuring involves the complex labyrinth of rules that will apply when the beneficiary is one or more trusts or trust systems. We have provided an easily understandable system to help planners understand what the rules are and which trusts they apply to.

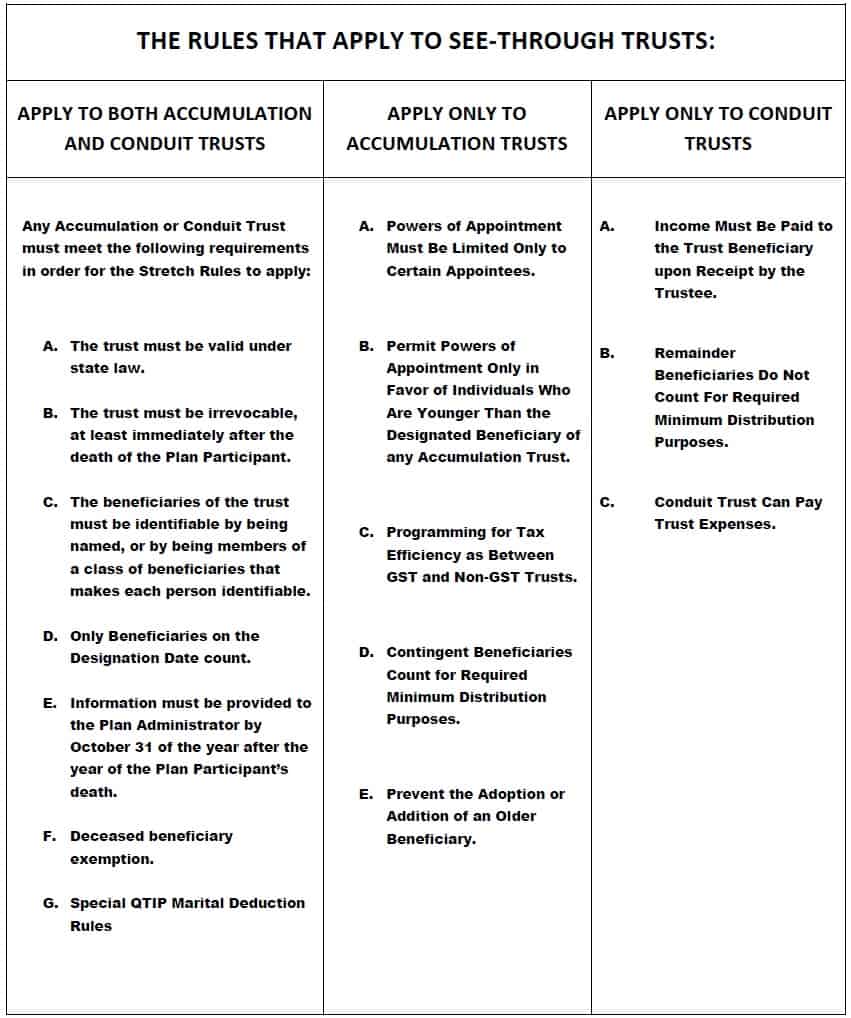

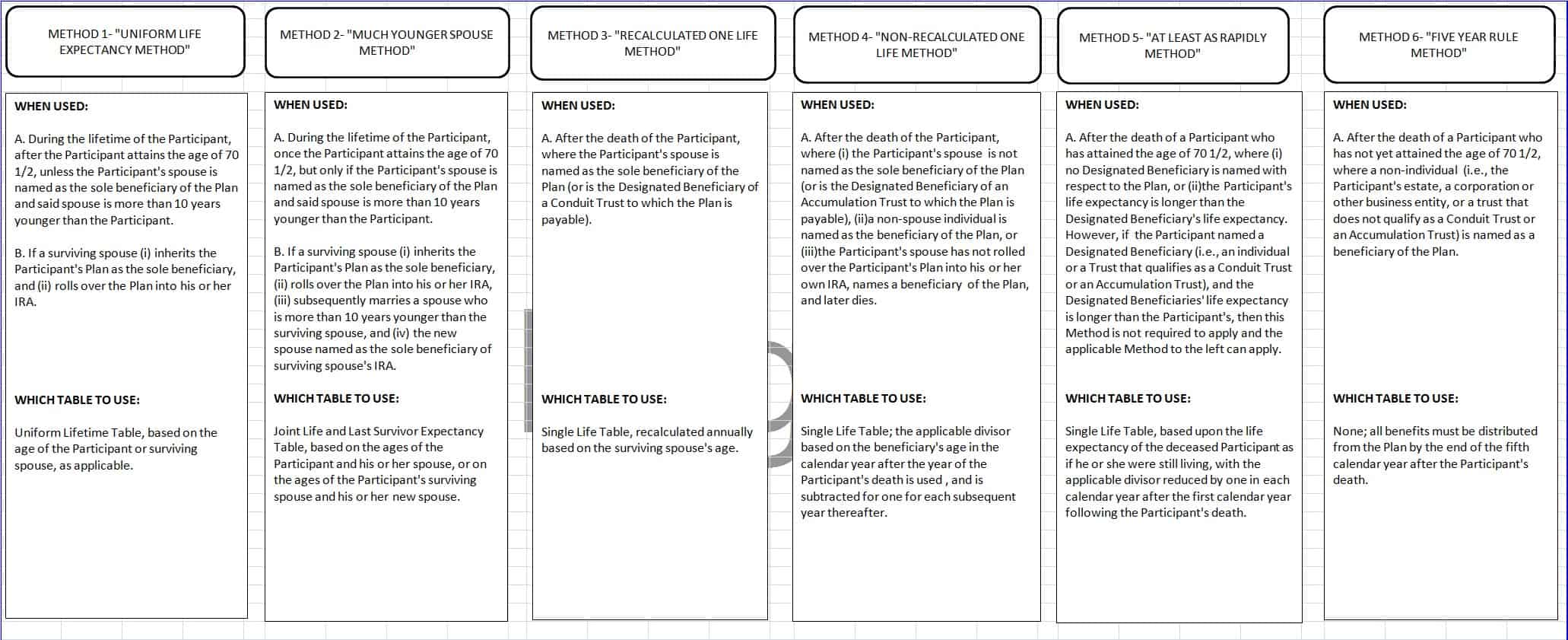

Illustration 3.0 below is a summary of which rules apply to each kind of see-through trust, and then the rules are explained in further but efficient detail below.

This week, we will be looking at rules that apply to conduit trusts only and toggling from a conduit trust to an accumulation trust (and vice versa.)

I. RULES THAT APPLY TO CONDUIT TRUST ONLY:

A. Income must be paid to the trust beneficiary upon receipt by the Trustee.

The trustee has no power to accumulate distributions from the IRA/Plan, and any distribution from the IRA/Plan must be paid directly to the trust beneficiaries[1].

B. Remainder beneficiaries do not count for Required Minimum Distribution Purposes.

Designated Beneficiaries are treated as sole direct beneficiaries of the IRA under a Conduit Trust. A Conduit Trust can thus have beneficiaries older than the desired Designated Beneficiary, Non-Persons as beneficiaries and unlimited power of appointment rights, so long as all distributions from the IRA/Plan to the trust are required to be paid to the Designated Beneficiary upon receipt from the IRA/Plan during his or her lifetime by trust during his or her lifetime. Remainder beneficiaries are disregarded as mere potential successors and if older than the designated beneficiary would not cause Required Minimum Distributions to be paid out over a shorter life expectancy.

C. Conduit Trusts can pay trust expenses.

The Designated Beneficiary is treated as the sole beneficiary for Required Minimum Distribution purposes regardless of whether the Conduit Trust can pay expenses. PLRs 200432027 and 200432029 concluded that the trust was “a valid, conduit, see-through trust” even though the trust assets could be used to pay expenses.[2]

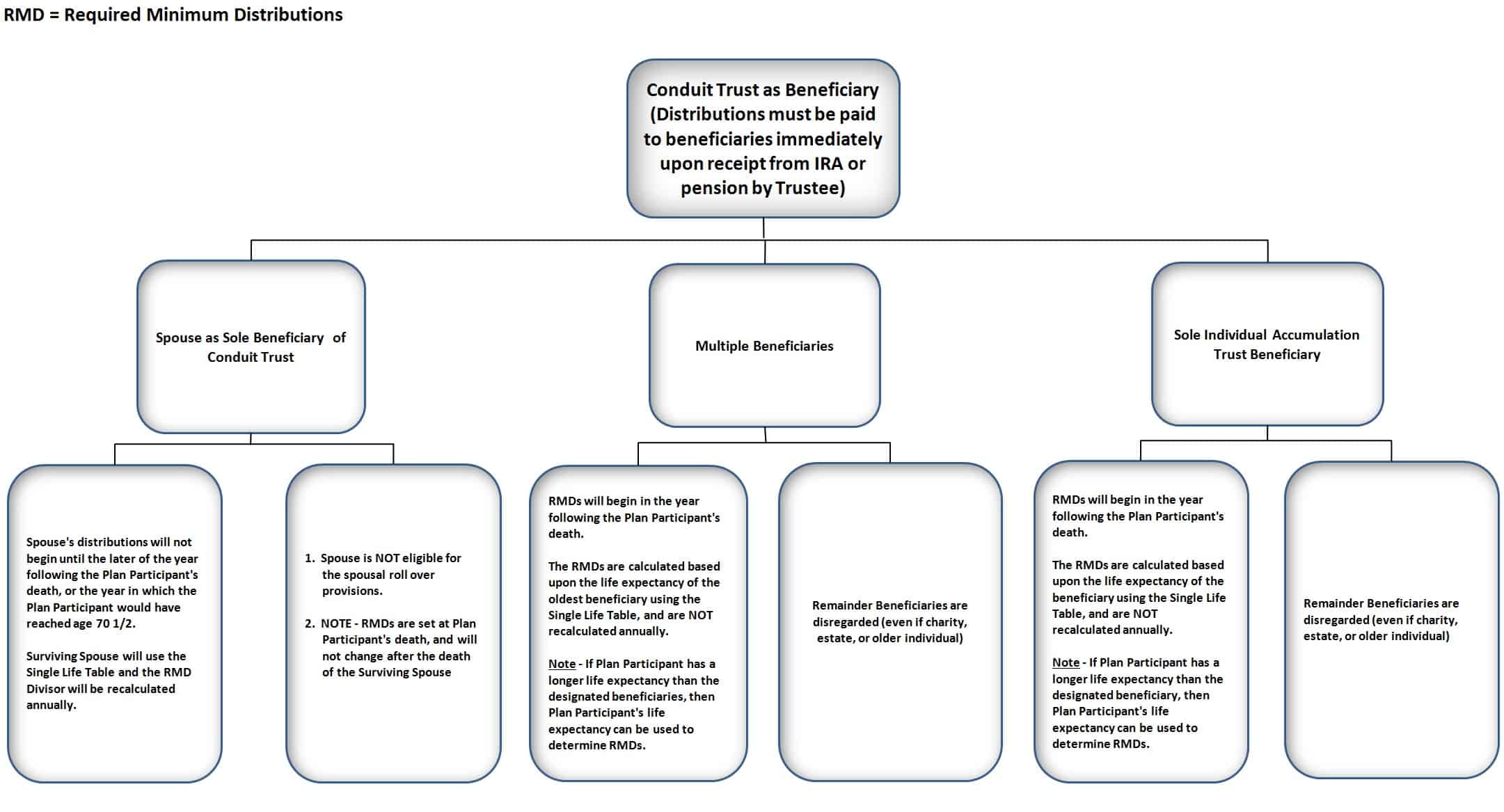

D. Conduit Trust Flow Chart

See Illustration 3.3 below to determine the applicable Payout Method.

Illustration 3.3

II. TOGGLING FROM A CONDUIT TRUST TO AN ACCUMULATION TRUST (AND VICE VERSA?)

Private Letter Ruling 200537044 confirmed that it is possible to “Toggle” what would have been a Conduit Trust into an Accumulation Trust on or before the Designation Date (September 30th of the calendar year of death of the Plan Participant). The conversion may only occur once, regardless of its direction. This can be accomplished by providing powers to independent Trust Protectors named under the trust agreement, if the exercise of such powers will be considered a disclaimer under state law that will result in the disclaimed powers and rights being considered as never having existed (i.e., void ab initio). The Trust Protectors would have the power to void the provision in the trust agreement that requires that all Required Minimum Distributions be currently distributed to the Designated Beneficiary of the trust. This can enable the trustee to accumulate IRA/Plan distributions in trust, and distribute such funds according to his or her discretion.

The Toggle provision described above will typically provide that the following changes will apply when the Toggle switch is flipped:

- Remove any non-person beneficiary as a beneficiary of the trust.

- Remove any possible individual beneficiary older than the Designated Beneficiary as a possible beneficiary of the trust.

- Restrict any power of appointment over trust assets to be exercisable solely in favor of individuals younger than the Designated Beneficiary.

- A non-generation skipping exempt Conduit Trust (where IRA/Plan distributions are all paid to the Designated Beneficiary) need not limit the exercise of any power of appointment to individuals younger than the Designated Beneficiary.

For example, a trust that provides that all IRA/Plan distributions are to be paid to the Surviving Spouse, and that a charity is a permissible beneficiary, could be changed by having the spouse disclaim the right to receive all IRA/Plan distributions and any power of appointment that he or she has over the IRA/Plan distributions (without disclaiming the right to receive amounts as needed for health, education, maintenance and support), and the charity can be paid out in full, or paid enough so that it agrees to no longer be a beneficiary as of the Designation Date. If the other requirements for an Accumulation Trust are met, then this will be considered to have been successfully toggled to an Accumulation Trust.

Toggling from a Conduit Trust to an Accumulation Trust has several benefits, including creditor protection and asset preservation, especially if the beneficiary is young, unsophisticated, or may have creditor, spendthrift, or divorce risk factors. Several states (including Florida) provide statutory creditor protection for inherited IRAs/Plans held by beneficiaries in their individual name. However, any distribution from a retirement plan will not be exempt from the beneficiary’s creditors in some states. As further discussed in Chapter One, Section I (G)(1) of this handbook, Florida Statute Section 222.21(2)(c) provides that any money or other assets, or any interest in any fund or account that is creditor exempt, does not cease to be exempt by reason of death or a direct transfer or eligible rollover to an inherited IRA/Plan. This is one reason why using an Accumulation Trust will often be favored over leaving an IRA/Plan outright to a Designated Beneficiary or to a Conduit Trust.

Conversely, toggling from an Accumulation Trust to a Conduit Trust could possibly occur by giving Trust Protectors the ability to mandate distribution of all Required Minimum Distributions made to the trust to a specified Designated Beneficiary. This could be beneficial in situations where a beneficiary, who once had creditor issues, is free of such issues within 9 months after the death of the Plan Participant. However, the authors are not aware of any ruling or precedential authority which would permit the toggling of an Accumulation Trust into a Conduit Trust, and the IRS might be less inclined to approve such toggling and may claim that this constitutes the addition of beneficiaries or trust provisions, as opposed to a disclaimer or removal.

Caution should be exercised when employing the toggling strategy. The endorsement of this strategy by the IRS has occurred only under Private Letter Rulings, which are not precedential except as to the requesting party. Thus, it is possible that the IRS could take the position that toggling powers held by Trust Protectors could cause a Conduit Trust to be an Accumulation Trust, even when not “toggled” on the basis of asserting that it is possible that distributions could be made to a person other than the Designated Beneficiary of the Conduit Trust before pulling the Toggle switch. This is one reason to not have beneficiaries other than individuals the same or younger ages than the intended “Designated Beneficiary.”[3]

*************************************************

[1] “All amounts distributed from A’s account in Plan X to the trustee while B is alive will be paid directly to B upon receipt by the trustee of Trust P…no amounts distributed from A’s account in Plan X to Trust P are accumulated in Trust P during B’s lifetime for the benefit of any other beneficiary.” Reg. § 1.401(a)(9)-5, A-7(c)(3), Example 2

[2] PLR 200432027 – 200432029 held specifically that the trust was a valid conduit see-through trust and that “The use of Trust T to pay expenses associated with the administration of Trust T (in effect, expenses associated with the administration of the Trust T assets for the benefit of Taxpayers B, C, and D) or the possibility, under these facts, that Trust T assets may be required to be used to pay an estate taxes due…does not change this conclusion.”

[3] Howard M. Zaritsky’s “The Year in Review” annual write-up for Bloomberg/BNA Tax Management Estates, Gifts & Trusts Journal includes the following discussion of Private Letter Ruling in Footnote #2:

Private letter rulings (PLRs) and technical advice memoranda (TAMs) are not legal precedents. §6110(k)(3). They may, however, show how the Service might address a similar case, and they have been cited and discussed by several courts. See, e.g., Wolpaw v. Commissioner, 47 F.3d 787 (6th Cir. 1995), rev’g T.C. Memo 1993-322 (taxpayers can rely on 20-year-old PLR, absent definitive regulations); Estate of Blackford v. Commissioner, 77 T.C. 1246 (1981) (noting that the Service litigation position was contrary to a prior PLR); Xerox Corp. v. United States, 656 F.2d 659 (Ct. Cl. 1981) (stating that PLRs are useful in ascertaining the scope of the doctrine adopted by the Service and demonstrating its continued and consistent application by the Service); Fanning v. United States, 568 F. Supp. 823 (E.D. Wash. 1983) (noting that a distinction between the facts of the instant case and those of prior cases had been cited in a TAM, and that TAMs are often relied upon by the courts).

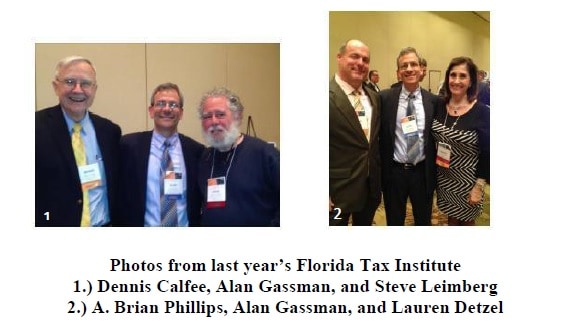

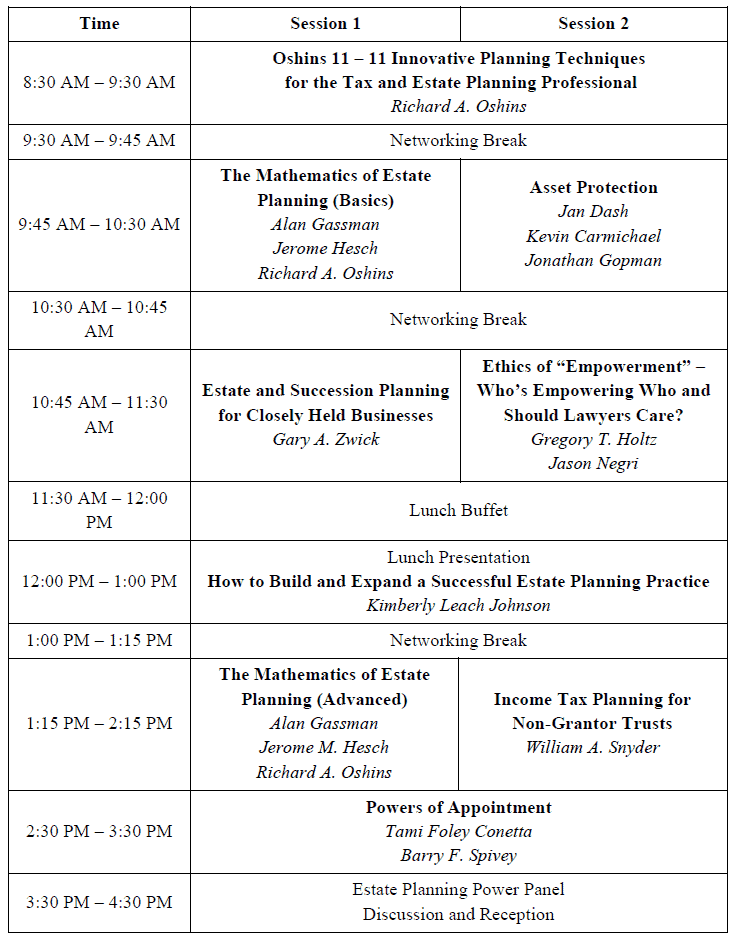

Seminar Spotlight

University of Florida Tax Institute

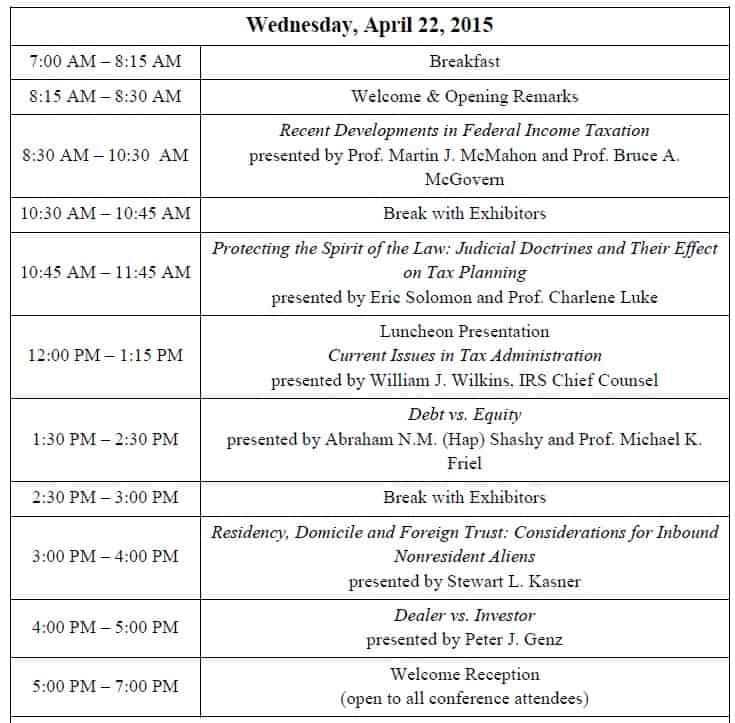

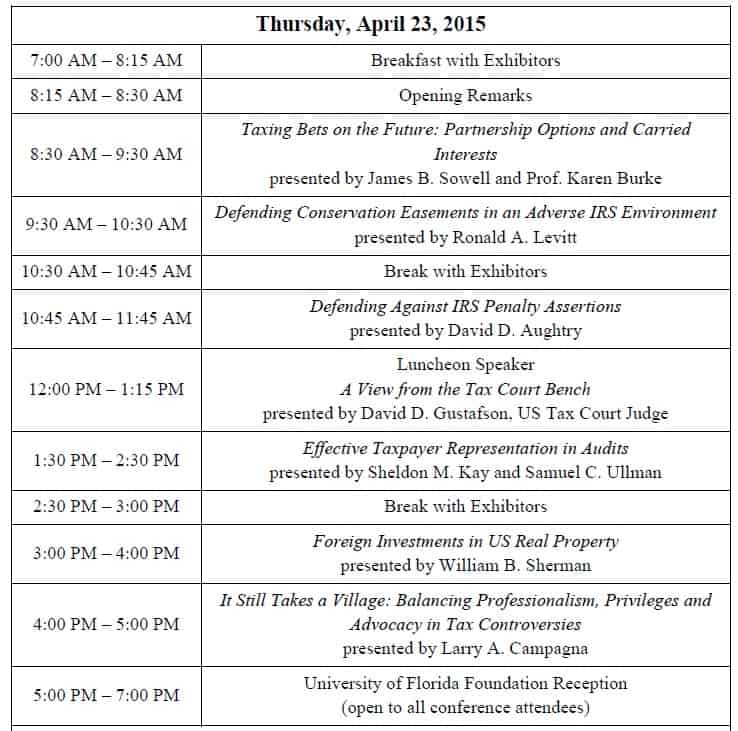

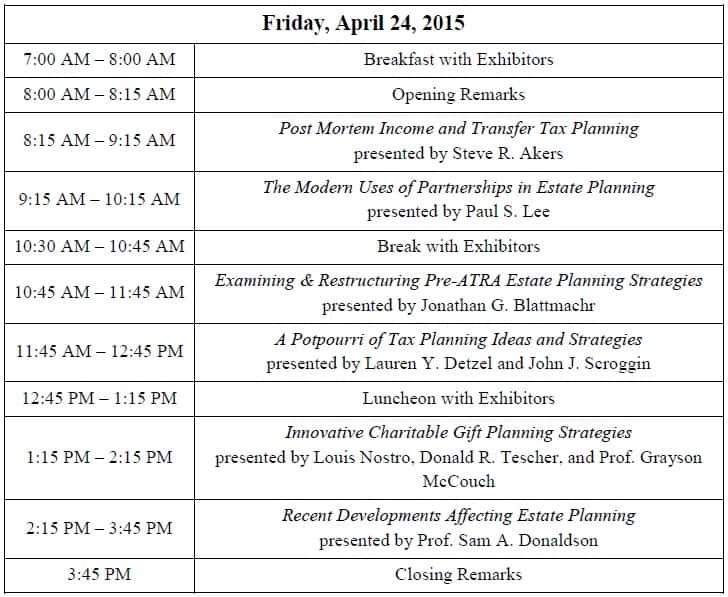

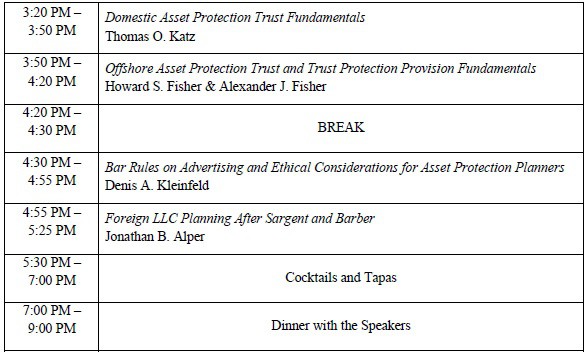

The Florida Tax Institute, sponsored by the University of Florida Levin College of Law, will take place at the Grand Hyatt Tampa Bay in Tampa, Florida on April 22nd, 23rd, and 24th, 2015.

This program features top speakers on tax, business, and estate planning issues. It is designed to be practical, informative, engaged, and state of the art!

Legal credit (CLE) will be available for a variety of states with an ethics program. Accounting, CFP, CTFA, PACE, and Enrolled Agents credit has also been requested in all states for attendance at the Florida Tax Institute.

The agenda for the Florida Tax Institute is as follows:

Each attendee to the Florida Tax Institute will receive a complimentary commemorative book provided by Gassman, Crotty & Denicolo, P.A.

To register for the conference, please click here.

For more information, contact The Florida Tax Institute at admin@floridataxinstitute.org or by phone at (216) 241-3922.

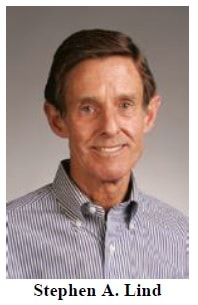

Donate to the Stephen A. Lind Eminent Scholar Chair

by Professor Dennis Calfee

The Stephen A. Lind Eminent Scholar Chair in Federal Income Taxation is part of a group solicitation project to raise an endowed fund of $1.5 million for the Graduate Tax Program at the Levin College of Law. This Chair honors Professor Stephen Lind, who taught tax courses at the College from 1970 to 1998 and was one of the founding faculty members of the Graduate Tax Program.

The income from the endowed fund will be used to attract an Eminent Scholar in Taxation who is not a member of the College faculty at the time an offer is extended to occupy this chair. This Eminent Scholar will replace faculty members who have taught in the graduate tax program for many years. This Chair ideally will be occupied by someone who mirrors Steve both professionally and personally.

Contributions to this project qualify for a deduction under Section 170. Pledges can be over a five-year period or payable in any year in the five-year period.

Thank you, in advance, for your assistance with this project to honor Steve. He has touched and influenced so very many in a very positive way over his academic tenure. If you have any questions, please contact Professor Dennis Calfee at (352) 273-0911.

Once the required pledge level is reached, we can all gather for a celebration. Currently, the Stephen A. Lind Eminent Scholar Chair, Fund number F019521, held at the University of Florida Foundation, has nearly $400,000 in contributions and pledges. Gassman Denicolo and Crotty are proud to be donors to this and to the Calfee chair, which is pictured below.

You can make an online contribution to the Stephen A. Lind Eminent Scholar Chair in Federal Taxation by clicking here or by calling the Gift Processing office at 1-877-351-2377.

Richard Connolly’s World

What’s New with Law School Programs

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the article of interest is “Law Students Leave Torts Behind (for a bit) and Tackle Accounting” by Elizabeth Olson. This article was featured in The New York Times DealBook on February 12, 2015.

Richard’s description is as follows:

A group of 170 Brooklyn Law School students cut short their winter break and headed back to campus in January for an intensive three-day training session. But not in the law.

Instead, they spent the “boot camp” sessions learning about accounting principles, reading financial statements, valuing assets and other basics of the business world – subjects that not long ago were thought to have no place in classic law school education.

Law schools as diverse as Brooklyn, Cornell, and the University of Maryland are offering focused sessions that aim to bring students up to speed on business practicalities.

Last year, Cornell University Law School started a similar business-focused workshop, called “Business Concepts for Lawyers.” The idea came from a Harvard Law School survey of employers released in February 2014, said Lynn A. Stout, a professor of corporate and business law at Cornell.

The 124 firms that responded to the survey called “What Courses Should Law Students Take? Harvard’s Largest Employers Weigh In,” listed accounting, financial statement analysis, and corporate finance as the best courses to prepare lawyers to handle corporate and other business matters.

Please click here to read this article in its entirety.

The second article of interest this week is “Law School Program Emphasizes Practical Skills” by Joe Palazzolo. This article was featured in The Wall Street Journal on January 4, 2015.

Richard’s description is as follows:

In recent years, as more clients have refused to pay for young lawyers to learn on the job, many law schools have tinkered with their curricula, making courses more practical and less theoretical as graduates compete for fewer openings.

Most of these efforts are too new to assess. But a study to be released this month suggests that the University of New Hampshire’s Daniel Webster Scholar Honors Program, launched in 2005, has largely succeeded in turning out new lawyers who are ready to practice law when they graduate.

Please click here to read this article in its entirety.

Humor! (or Lack Thereof!)

In the News

by Ron Ross

The NSA is now listening in on the string tied between two tin cans. They’ve discovered that Bobby was totally lying when he said he kissed Sally in the treehouse.

************************************

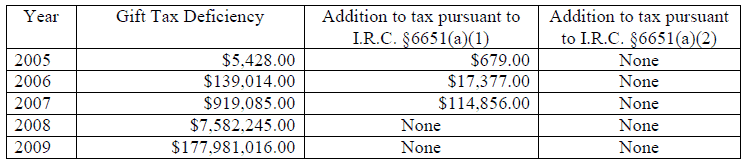

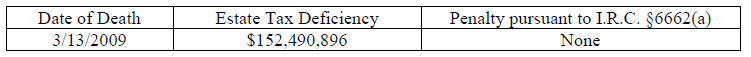

100 Year Old Defendant Behind on Taxes Tries Stalling Tactics Against the US Government – “One of us is going to go eventually,” he said. “I’m betting it’s them. But I’m a winner either way.”

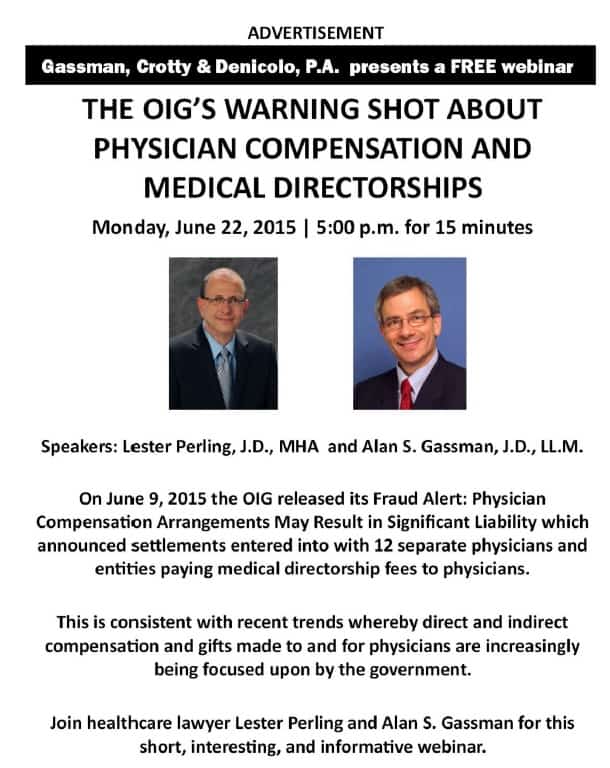

Upcoming Seminars and Webinars

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Kenneth Crotty, and Christopher Denicolo will be presenting a not-so-free 90-minute webinar for Bloomberg BNA Tax & Accounting on WHY FLORIDA IS DIFFERENT – IMPORTANT THINGS THAT ESTATE AND TAX PLANNING PROFESSIONALS NEED TO KNOW.

Date: Thursday, April 16, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*********************************************************

LIVE FREE ETHICS CREDIT WEBINAR:

Alan Gassman and Dr. Srikumar Rao will present a free 50-minute webinar on HOW TO HANDLE STRESSFUL MATTERS IN AN ETHICAL WAY – PART II.

This webinar is a continuation of the How to Handle Stressful Matters in an Ethical Way webinar that was presented by Dr. Rao and Alan Gassman on February 19, 2015. This webinar will qualify for 1 hour of CLE Ethics Credit and is classified as Advanced.

See Professor Rao’s Ted Talk YouTube video, and you will understand how important this webinar might be to accelerating your law practice and enhancing your enjoyment of the practice as well.

Dr. Srikumar Rao is the creator of the original Creativity and Personal Mastery (CPM) course that has helped thousands of executives and entrepreneurs achieve quantum leaps in effectiveness. He earned a Ph.D. in Marketing from Columbia University and has taught the course at Columbia University, Northwestern University, University of California at Berkeley, and the London School of Business. He is the author of Happiness at Work and Are You Ready to Succeed? which can be reviewed by clicking here. Are You Ready to Succeed? has been published in over 60 languages!

Date: April 21, 2015 | 12:30 p.m.

Location: Online webinar

Additional Information: Please click here to register or email Alan Gassman at agassman@gassmanpa.com for more information.

***************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Kenneth Crotty, and Christopher Denicolo will present a 90-minute webinar for Bloomberg BNA Tax & Accounting on MATHEMATHICSLAND FOR ESTATE PLANNERS.

This webinar includes over 30 interactive spreadsheets and explanatory tools that you need to know how to use to best serve your clients!

Date: Monday, April 27, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE OLDSMAR PRESENTATION:

FICPA SUNCOAST SCRAMBLE GOLF TOURNAMENT

Kenneth J. Crotty and Christopher J. Denicolo will speak at the FICPA Suncoast Scramble Golf Tournament on the topic of MATHEMATICS FOR ESTATE PLANNERS INCLUDING 10 ESTATE PLANNING STRATEGIES NOT TO MISS.

Date: Friday, May 1, 2015 | CPE Presentations from 9:00 AM – 11:30 AM

Location: East Lake Woodlands Country Club | 1055 E Lake Woodlands Parkway, Oldsmar, FL 34677

Additional Information: For more information about registration, sponsorship, or this event, please click here or click here to download the Tournament brochure.

***********************************************************

LIVE NAPLES PRESENTATION:

2nd ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

Alan Gassman, Jerry Hesch, and Richard Oshins will present THE MATHEMATICS OF ESTATE PLANNING. If you liked Donald Duck in Mathematics Land, you will love The Mathematics of Estate Planning. This will not be a Mickey Mouse presentation.

Other speakers include Richard Oshins on 11 Outstanding Planning Ideas, Jonathan Gopman on Asset Protection, Bill Snyder, Elizabeth Morgan, Greg Holtz, and others.

Please let us know any questions, comments, or suggestions you might have for this amazing conference, which features dual session selection opportunities in one of the most beautiful conference facilities that we have ever seen.

Date: Friday, May 1, 2015

Location: Ave Maria School of Law | 1025 Commons Circle, Naples, Florida

Additional Information: For more information, please visit http://estateplanning.avemarialaw.edu/ or email Alan Gassman at agassman@gassmanpa.com.

******************************************************

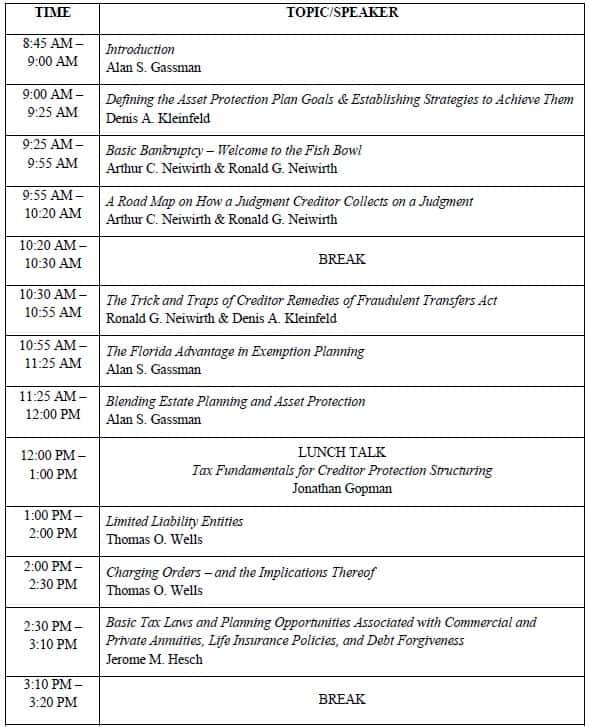

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PRESERVATION PROGRAM

Denis Kleinfeld and Alan Gassman have released the schedule and topics for FUNDAMENTALS OF ASSET PROTECTION AND ADVANCED STRATEGIES. This seminar will be presented on May 7th and May 8th, 2015, and is sponsored by the Tax Section of the Florida Bar. Attendees can select one day or the other, or to attend both days.

Day One will be for fundamentals and will be an excellent review or an introduction to the basic rules and practice aspects of creditor protection planning for both new and experienced practitioners.

Day Two will be an advanced treatment of creditor protection and associated planning, which will be of great use to both new and experienced practitioners.

Date: May 7 – 8, 2015

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: To register for this conference, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, and Barry Flagg will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on THE TAX ADVISORS GUIDE TO PERMANENT LIFE INSURANCE AND STRUCTURING TOOLS AND TECHNIQUES.

Date: Tuesday, May 12, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

******************************************************************

LIVE BRADENTON, FLORIDA PRESENTATION

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Tuesday, May 12, 2015 | Time TBA

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE STUART, FLORIDA PRESENTATION

Alan Gassman will be the featured “headline” speaker the Martin County Estate Planning Council Annual Tax and Estate Planning Seminar. He will be doing a three-hour talk on the topics of JESTs, MATHEMATICS FOR ESTATE PLANNERS, AND THE ESTATE PLANNER’S GUIDE TO PLANNING FOR IRA AND PENSION BENEFITS – YES, YOU CAN FINALLY UNDERSTAND THESE RULES!

Date: May 15, 2015 | 8:15 AM – 4:30 PM; Alan Gassman speaks from 9:00 AM to 12:00 PM

Location: Stuart Corinthian Yacht Club | 4725 SE Capstan Avenue, Stuart, FL 34997

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Lisa Clasen at lclasen@kslattorneys.com.

************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will be presenting a free 30-minute webinar on ARBITRATING TRUST AND ESTATES DISPUTES.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many vary useful articles thereon.

Date: Tuesday, May 19, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR

Alan Gassman, Ken Crotty, and Chris Denicolo will present a webinar on A PRACTICAL TRUST PLANNING CHECKLIST AND PRACTITIONER COMPLIANCE GUIDE FOR FLORIDA CPAs for the Florida Institute of CPAs.

Review a practical planning checklist and practitioner tax compliance guide to facilitate implementing a comprehensive overview of practical planning matters and tax compliance issues in your practice. This presentation will cover over 20 common errors and missed planning opportunities that accountants need to understand and counsel their clients on.

This course is designed for practitioners who wish to assure that trust planning structures and compliance are both aligned with client objectives and that common catastrophic errors and misconceptions can be corrected.

Past attendees have indicated that this is an interesting and practical presentation that offers a great deal of practical information for both compliance and planning functions, based upon an easy to follow checklist approach. Includes valuable materials.

Date: May 21, 2015 | 10:00 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Thelma Givens at givenst@ficpa.org. To register, please click here.

**************************************************

LIVE MIAMI LAKES WORKSHOP:

Alan Gassman will be speaking at the Miami Lakes Bar Association Luncheon on the topic of ACCELERATING YOUR LAW PRACTICE. This luncheon will qualify for 2 CLE credits.

Date: Thursday, May 21, 2015 | 11:45 am – 1:45 pm

Location: Italy Today | 6743 Main Street, Miami Lakes, FL 33014

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

******************************************************

LIVE WEBINAR:

Alice Rokahr, President, Trident Trust Company (South Dakota) Inc., and Alan S. Gassman will present a free, 30-minute webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTS – DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

Date: June 9, 2015 | 12:30 pm

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or click here to register for this webinar.

**********************************************

LIVE BLOOMBERG BNA WEBINAR:

Professor Jerome Hesch, Alan Gassman, Ed Morrow, Christopher Denicolo, and Brandon Ketron will be presenting a 90-minute webinar for Bloomberg BNA Tax & Accounting on ESTATE AND TRUST PLANNING WITH IRA AND QUALIFIED PLAN BENEFITS: AN UNDERSTANDABLE SYSTEM WITH CHARTS AND EASY-TO-UNDERSTAND MATERIALS.

This presentation will include a 300 page E-book for each attendee.

Date: Wednesday, June 10, 2015 | 2:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please email Alan Gassman at agassman@gassmanpa.com.

*******************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Date: August 22, 2015 | 9:00 AM – 5:00 PM

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Friday, October 23rd and Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE PRESENTATION:

RUTH ECKERD HALL PLANNING GIVING COUNCIL MEETING

This exciting two-part event will feature an educational presentation and a networking session. Attorneys and CPAs may receive CLE and CPE credit for attending the educational presentation.

The educational presentation will be an entertaining, interactive workshop led by Jack Halloway, a well-known improvisational coach and actor. He is directing “The Complete Works of William Shakespeare (Abridged)” and will share some thoughts on how Shakespeare used law, lawyers, and money in his plays. Some improv will also be included.

Jack Halloway’s presentation will be followed by a social networking and info session. Enjoy some wine and time with fellow Planned Giving enthusiasts!

Everyone who brings a potential donor or new member to the Planning Giving Council will be entered into a raffle for 2 tickets to an upcoming show.

Date: April 21, 2015 | Educational Presentation begins at 4:30 PM | Networking sessions begins at 5:30 PM

Location: The New Murray Theatre at Ruth Eckerd Hall

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com. RSVPs may be sent to Maribeth Vongvenekeo at maribeth@gassmanpa.com, Suzanne Ruley at sruley@rutheckerdhall.net, or Kristy Philippe at kristy.philippe@ms.com.

******************************************************

LIVE PRESENTATION:

2015 UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: Wednesday through Friday, April 22 – 24, 2015

Location: Grand Hyatt Tampa Bay | 2900 Bayport Drive, Tampa, FL 33607

Additional Information: Please visit http://www.floridataxinstitute.org/agenda.shtml for a complete schedule or contact Bruce Bokor at bruceb@jpfirm.com for more information.

******************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: Hotel information to be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

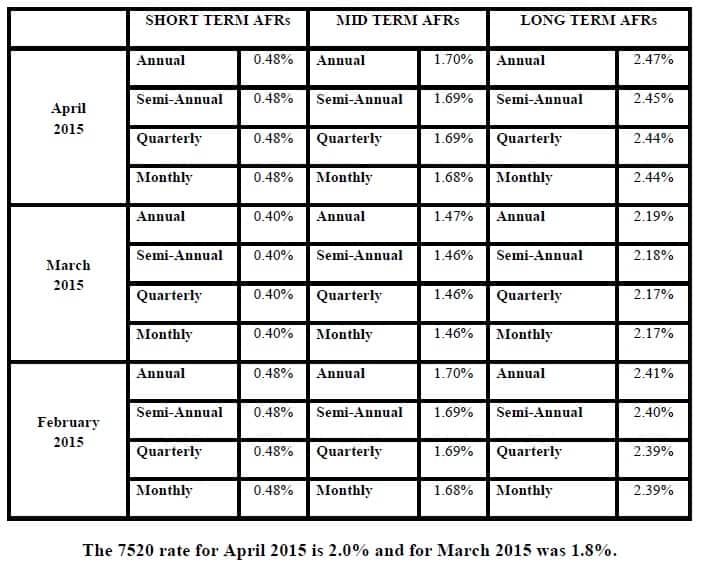

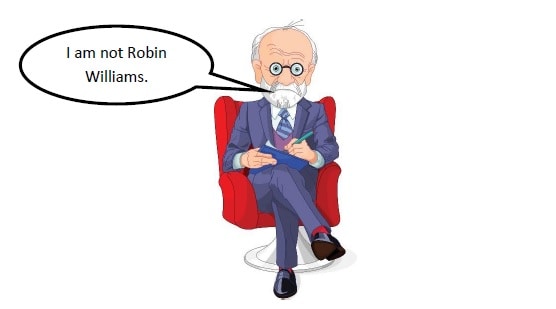

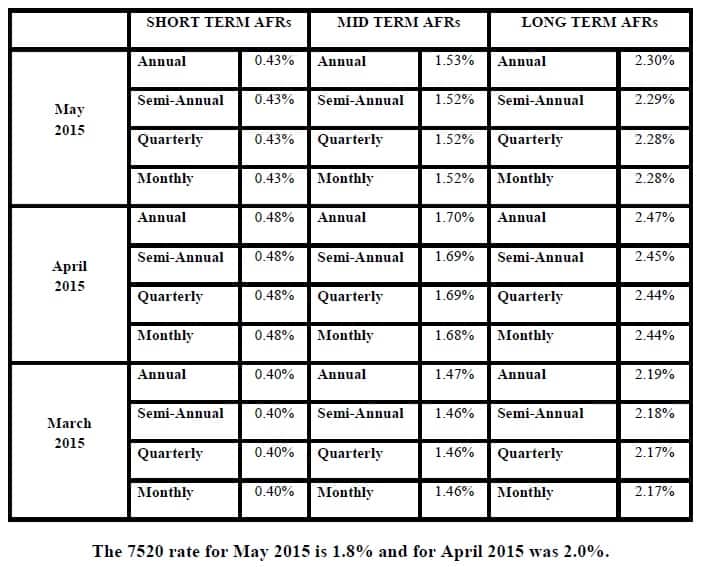

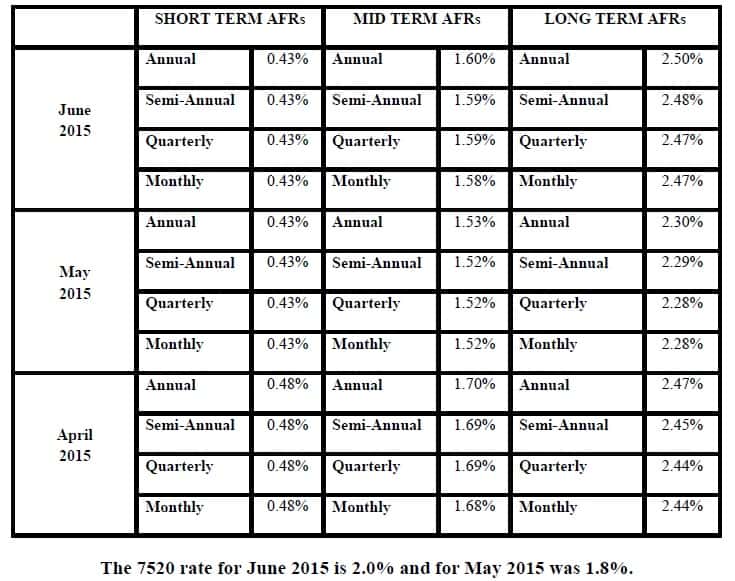

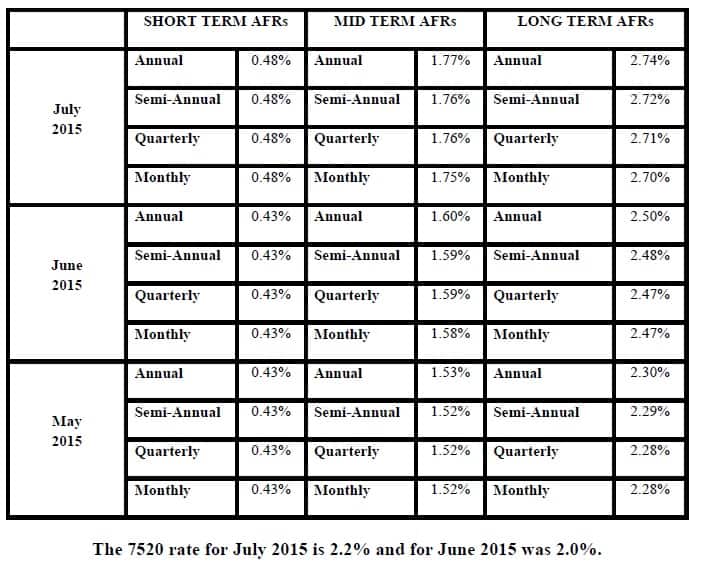

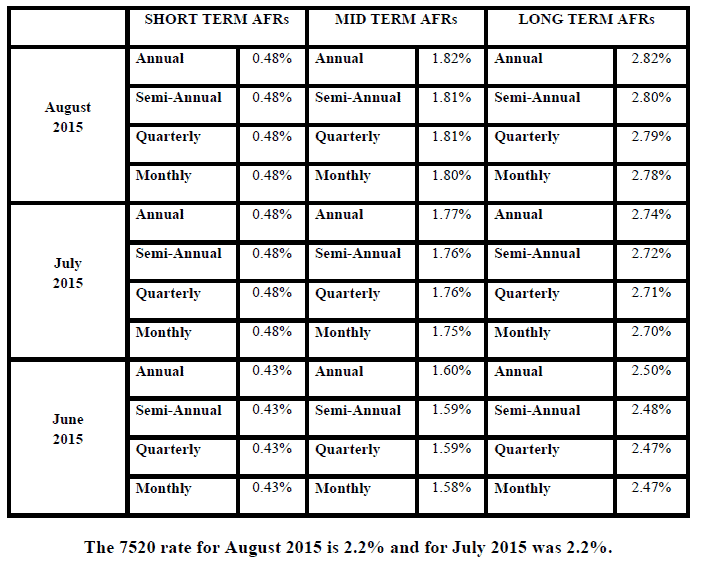

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.

The post The Thursday Report – 4.9.15 – The Lind Chair and More Naked Truth About See-Through Trusts appeared first on Gassman, Crotty & Denicolo, P.A..